In the Summer issue of Building Interest, we examined the outgoing Conservative government's legislative achievements in the built environment sector.

In this issue, following the Autumn budget, we consider the government's plans for building, engineering, construction and infrastructure. We've extracted all the pertinent construction industry points (so you don't have to) so buckle up!

Building Bigger and Better

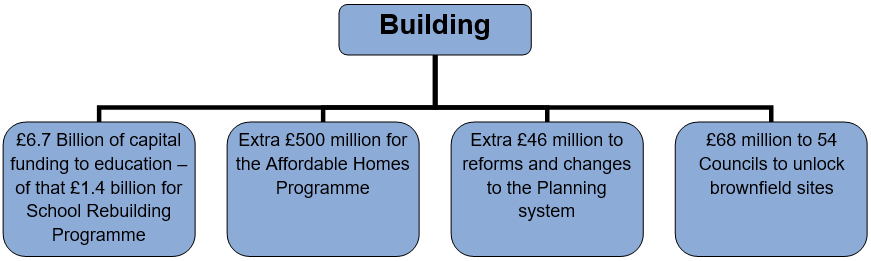

A sizable portion (about £6.7 billion) of 2025-26 capital funding is to go to education in England, an increase of 19% in real terms from 2024-25. Covering more than pens and paper, this is to include £1.4 billion for the government's school rebuilding programme which will see a £550 million increase on this current year.

To help alleviate the crisis in prisons, the government also plans to continue the Prison Building Programme, although this will be alongside their examination of "tough alternatives to custody".

The government also plans to build more homes to unlock growth, adding £500 million to the Affordable Homes Programme – putting them on the path to building 1.5 million homes over this Parliament (with up to 5,000 of the additional homes built being affordable).

Building these houses in the right places is vital to the countries long-term economic growth, as the government acknowledges. The key to unlocking the space for some of these homes may be found in the governments interest in ‘brownfield passports' to ensure that there is a more "straightforward approval for development[s]".

Another key to unlocking these homes is the governments proposed changes to the planning system, with £46 million of additional funding to support recruitment and training of 300 graduates and apprentices into local planning authorities, as well as to accelerate "large sites that are stuck in the system".

Other notable developments:

- With the funding, delivered through the Brownfield Land Release Fund, councils will be able to cover the cost of decontamination, clearing disused buildings or improving infrastructure such as internet, water and power. As a result, land will be released to enable 5,200 homes to be built across the country (Thousands of new homes to be built as government unlocks brownfield sites - GOV.UK)

- Only 62 of the more than 500 schools on the governments school rebuilding programme, have had contracts awarded to construction companies ('The lights go out when it rains' - school rebuilding plan missing targets - BBC News).

- Plans to: increase capacity at HMP Guys Marsh by 31%; change HMP Liverpool from Cat B to Cat 6 and; construct a new £300 million Cat C super prison next to HMP Springhill and HMP Grendon are halted, following collapse of builder ISG (Prison building plans facing delays over ISG collapse | Construction Enquirer News).

- Consultation of proposed reforms to the National Planning Policy Framework and other changes to the planning system, closed on 24 September 2024 (Proposed reforms to the National Planning Policy Framework and other changes to the planning system - GOV.UK).

- The government announced the New Homes Accelerator programme, which will include a new expert group to speed up delivery of stalled housing sites (New Homes Accelerator programme to unblock thousands of new homes - GOV.UK).

Engineering our economy back to stability

The government has proposed to provide financial support to UK companies supplying "critical minerals" to UK exporters in high growth sectors such as EV battery production, clean growth, aerospace and defence, in an attempt to further not only the governments NetZero ambitions but also supply chain resilience in the sector.

Climate change is likely to continue to heavily influence the engineering sector, not least in agriculture which has been a target for environmental linked change in the Autumn budget. The government will invest £5 billion over two years to "support the transition towards a more productive and environmentally sustainable agricultural sector in England", however, the finer details regarding how this is to be achieved have not been forthcoming thus far.

Another industry which could see a windfall from the government budget is nuclear energy, leading to more engineering development in this sector. While the budget settlement for nuclear energy provides £2.7 billion of funding to continue the Sizewell C development through 2025-26, a final investment decision on whether to proceed with this project will not take place until Phase 2 of the spending review.

In keeping with the theme of net zero, the government also plans to provide support for the first round of electrolytic hydrogen production contracts, with the aim of harnessing this renewable energy to decarbonise the industry across the UK.

Other notable developments:

- The Department for Energy Security and Net Zero (DESNZ) published details of a new subsidy scheme – the Sizewell C Devex Scheme – to enable continued support to the development of the proposed new nuclear power plant Sizewell C (SZC) to the point of a Final Investment Decision (FID) and thereby ultimately reach operation (Sizewell C Development Expenditure (Devex) Subsidy Scheme - GOV.UK).

- The previous governments 'Great British Nuclear' (GBN) were lined up to buy land at two Hitachi sites – the government reported in the Autum budget that GBN Small Modular Reactor competition is ongoing and has entered the negotiation phase with shortlisted vendors. Final decisions will be taken in the spring (Autum Budget 2024).

- Britain's biggest EV battery factory (owned by Agratas, a Tata Group subsidiary) will be on the Gravity Smart Campus near Bridgwater, Somerset. The factory will be a £4 billion project (Site of Britain’s biggest EV battery factory to be on ‘smart campus’).

- Recent reports show that the UK's commercial space industry is growing rapidly, with a turnover of over $22 billion in 2022. The stated ambition is to capture 10% of the global space market by 2030. Accelerating growth year on year, the UK is a world leader in nano and small satellites (United Kingdom - Aerospace and Defense).

Construction – are we all building from the same hymn sheet?

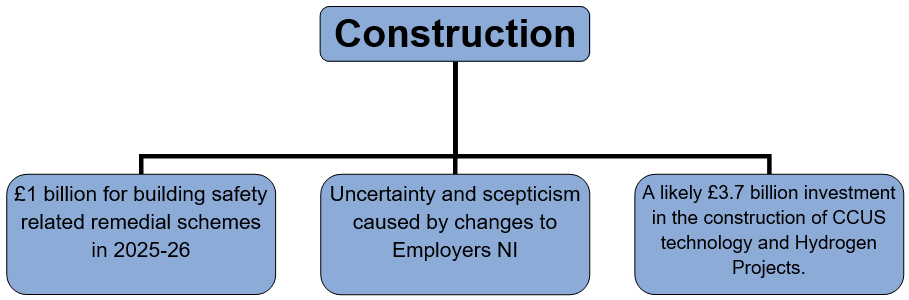

The government plans to invest £1 billion in 2025-26, into building safety in response to the Grenfell Tower fire. The finer details of these plans are yet to be revealed.

Certain elements of the government's budget may create issues within the construction industry; most notably the mandated increase to Employer NI contributions is feared to stifle recruitment in the construction industry and cast more uncertainty on some already cash dwindling contractors. This is already in the context of a skills shortage and a squeeze on labour. This may lead to slower than desired uptake in some of the government's ambitious development plans.

The government has set aside £3.9 billion for 2025-26 in order to deliver Carbon Capture and Storage Clusters (CCUS) and to kickstart the hydrogen industries. The Department for Energy Security and Net Zero has anticipated a £3.7 billion spend on construction, most notably for these CCUS and Hydrogen projects, subject to further decisions, a commendable investment into the construction industry.

Other notable developments:

- New employer tax increase threatens stability of plumbing and heating industry, jeopardising investment and job creation in an already fragile construction sector - Fiona Hodgson, Chief Executive of SNIPEF (Changes to employer NI puts "jobs and growth at risk" - SNIPEF warns - Installer Online)

- As of July 2024, overall, 2,299 buildings (representing 50% of residential buildings 11 metres and over in height identified with unsafe cladding) have either started or completed remediation works. Of these, 1,350 buildings (29% of residential buildings 11 metres and over in height identified with unsafe cladding) have completed remediation works (Building Safety Remediation: monthly data release - July 2024 - GOV.UK)

- The government pledges £22 billion for two carbon cluster projects in Merseyside and Teesside, a move to "reignite our industrial heartlands" and "kickstart growth". (Government pledges nearly £22bn for carbon capture projects - BBC News)

Tomorrow's infrastructure today (and RIP the Stonehenge Tunnel)

The government, aspiring to deliver growth in "clean energy industries" such as AI, data centres and manufacturing, aims to accelerate grid connection and build new network infrastructure in order to "unblock" private investment. They are working with the new National Energy System Operator and Ofgem to develop "a robust grid connection process", to ensure viable projects are "connected in a timely manner".

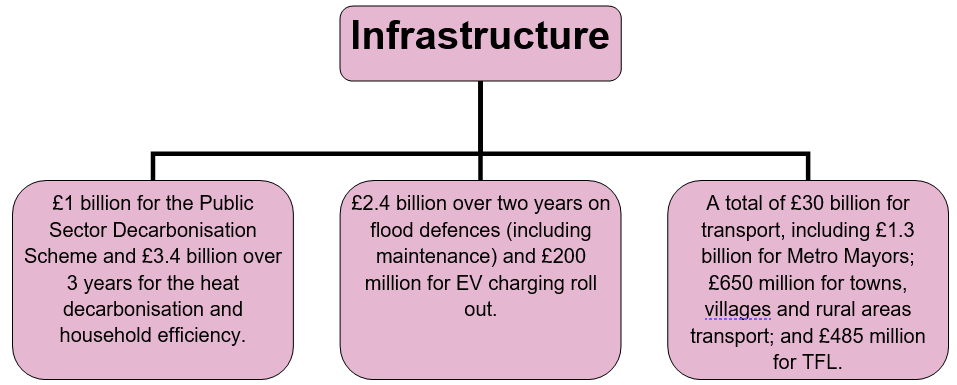

On the greener side of things, the government plans to deliver £1 billion of funding through the Public Sector Decarbonisation Scheme to decarbonise the public estate as well as take their first steps towards their "Warm Homes Plan", committing an extra £3.4 billion over the next 3 years, towards heat decarbonisation and household energy efficiency. A more reactionary investment of £2.4 billion over the next two years has been set aside for flood resilience to support the building of new flood defences, alongside flood defence maintenance of existing assets.

The government has also approved the construction of four solar farms, which will provide almost two gigawatts of electricity generating capacity. Additionally, the government will be investing over £200 million in 2024-26 to accelerate EV charging roll out, including on street Charge Points as part of the governments efforts to ensure all new vehicles in the UK are zero emission by 2035.

The government has cancelled several 'low value' schemes to alleviate the £3.5 billion they state related to unfunded pressure discovered in the public spending audit. Cancelled schemes include: A303 Stonehenge tunnel, the A27 schemes, and the Restoring Your Railway programme.

This budget is certainly going places in terms of transport, with £30 billion in spending in 2025-26. Labour plans to unlock 'growth-enhancing schemes' such as East West Rail as well as improving the performance and reliability of rail services, ensuring the rail sector can operate effectively and become financially sustainable, laying the groundwork for the transition to Great British Railways. Staying on track, the government also plans to upgrade the TransPennine Route between York and Manchester, deliver the East West Rail Route, connecting Oxford, Milton Keynes and Cambridge (including investing £10 million to enable wider infrastructure works in Cambridge to realise the full potential of this Route), progress HS2 Phase One (including funding for tunnelling so trains can run to Euston) as well as increasing the capacity of West Coast Mainline.

The government will provide a total of £1.3 billion of funding in relation to local transport spending for Metro Mayors; £650 million to improve transport connections improve in our towns, villages and rural areas; and £485 million for TFL's capital renewal programmes.

The budget plans to progress infrastructure projects through improvements to the planning system including most notably a new roll-on/roll-off facility in Immingham Eastern Ro-Ro Port Terminal and the London City airport expansion.

Other notable developments:

- HS2 trains will be able to run all the way to Euston after the chancellor, Rachel Reeves, committed to funding tunnelling work to the central London station (HS2 will run to London Euston after chancellor commits to funding | HS2 | The Guardian).

- East West Railway, due to open next year, and will use hybrid batteries (East West Rail trains to use hybrid batteries to reduce emissions - BBC News)

- London City Airport application to expand has been approved, increasing capacity from 6.5 million to 9 million passengers a year by putting on more weekend and early morning flights (London City airport expansion given green light by ministers | Air transport | The Guardian).

- Eastern Ro-Ro Terminal has been granted development consent by the Secretary of State for Transport (Immingham Eastern Ro-Ro Terminal development consent decision announced - GOV.UK).

- Wiltshire Council "extremely dismayed and disappointed" by the cancellation of the A303 Stonehenge tunnel, as they claim " These improvements are needed now to ease traffic congestion on the A303 and reduce traffic in our communities, and also ensure economic growth in Wiltshire, unlocking jobs and investment in the wider south-west region" (Stonehenge tunnel scheme cancelled by government - BBC News).

- The Government has launched the British Infrastructure Taskforce to boost investment in infrastructure and drive growth nationwide (Government launches British Infrastructure Taskforce - GOV.UK).

What do the Lawyers think?

Whilst we have summarised government's planned investment for building, engineering, construction and infrastructure, as provided for in the Autumn budget, the delivery and outcome of this governments proposals could be very different.

This budget has already cut some of the previous government's investment in schemes such as the A303 Stonehenge tunnel and in the coming years some of this government's own schemes could be on the chopping block also. The government will have to contend with several variables in the delivery of their plans, which could vastly hamper the outcome, not least the uncertainty in the construction industry as exhibited by the collapse of builder ISG, on whom the government relied on for a number of prison upgrades.

The government has set out some ambitious plans, such as their pledge to build 1.5 million homes during this Parliament, and it is difficult to see how this can be achieved without vast changes to the current construction landscape and a more ubiquitous adoption of modern methods of construction in the delivery of new projects.

Investment in construction has always been a lever pulled in times of economic uncertainty to promote jobs, growth and to shore up confidence in UK plc – the cash has been committed, the plans have been made, let's see how much this government will continue to support our sector during the next five years.